JFG, one of India's fastest growing non-banking financial companies (NBFCs), offers tailored financial solutions to a wide range of customers across personal loans, business loans, home loans, etc.

As a wholly-owned subsidiary of JFG, we constantly strive to meet the unique financial needs of customers through our diverse product offerings. Our loan portfolio includes a range of financial solutions including MSME loans, women group loans and property financing.

More InformationWe can save your money.

Production or trading of good

Our life insurance is flexible

Our presence across the country enables us to provide good service and a superior customer experience.

This list recognizes companies that have earned the confidence of consumers, investors and employees by producing quality services.

Learn MoreWe provide a 30-day anytime money back guarantee on most Loan & Insurance services.

Learn MoreOur plans that link insurance and investments and allow you to buy units of the funds that have a lot of flexibility in their investment options.

Learn MoreA comprehensive guide with cost-effective methods and best practices that can help you provide 24/7 customer support in no time.

Learn MoreWe offers tailored financial solutions to a wide range of customers across personal loans, business loans, home loans, etc.

JFG provides Education Loans for students looking to study in India and abroad. You can get a loan starting from Rs. 50,000 at attractive interest rates. Find out the education loan eligibility criteria for availing an JFG student loan.

Read More

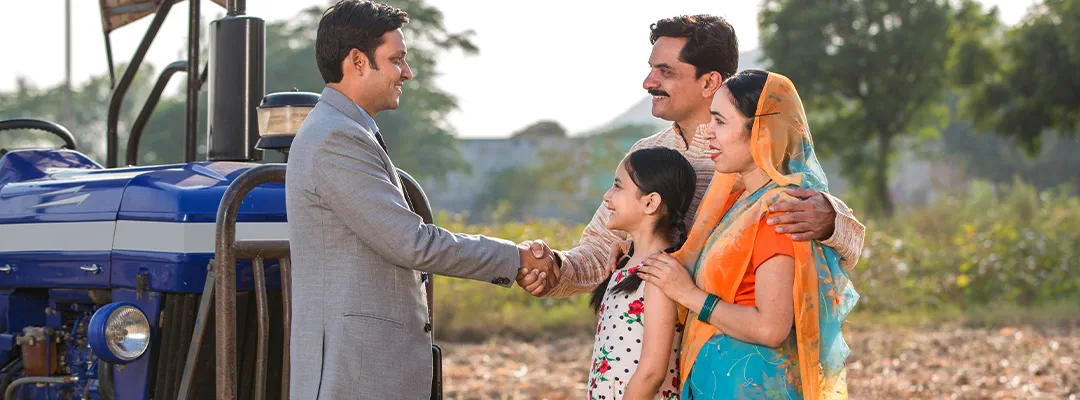

Agriculture is one of the main occupations in India. Farmers can apply agricultural loan for investment as well as short tenure purposes, such as production.

Read More

offers tailored financial solutions to a wide range of customers across personal loans, business loans, home loans, etc.

Read MorePersonal Loan

Already, your service is the best among the competitive companies.

Personal Loan

All services and processes were executed perfectly.

Personal Loan

All services are the best.

Business Loan

My request was considered politely and solved. The service executive was good in her speech and interaction and was helpful.

Business Loan

Overall good experience and good service provided.

Channel partners bring their expertise, customer relationships, and localized knowledge to the table, helping the manufacturer tap into new markets, customer segments, or geographic regions that they might not have been able to